Companies Use Private Fleets To Improve Service and Control Costs

Private fleets in 2022 continued to position themselves as a cost-effective transportation solution, with many fleets expanding their operations to better manage their supply chain, according to the National Private Truck Council’s (NPTC’s) 2023 Benchmarking Survey.

“This year’s survey paints the picture of a private fleet that provides companies with control over logistics costs and service on both the inbound and outbound sides of the supply chain and protects the parent company from the volatility present in the for-hire side of the business,” the report stated.

Customer service, cost and control remain the top reasons companies reported operating private fleets. “Operating a private fleet provides control over service levels, guarantees availability, and assures cost-competitive transportation alternatives regardless of market conditions,” according to the report, which was sponsored by Penske.

Companies also use private fleets to enhance their brand, with 73% of respondents saying they use the trailer as a “rolling billboard.”

Efficient Growth

Volume was up for private fleets, growing 8.4% year-over-year, and companies were efficient in managing the growth, with just a 3.8% increase in mileage. However, supply chain pressures crimped the ability of many corporations to operate their private fleets at fully optimized levels, and fleets reported a drop in equipment and driver utilization.

Private fleets continue to dominate on outbound transportation, with respondents reporting they handle 70% of their outbound needs, which is up from 68% last year and marks the highest percentage in the history of the report. For-hire motor carriers handle 17% of all outbound freight movements, dedicated contract carriers perform 11%, a slight decrease from last year’s 12%, and the remaining 1% is carried on rail.

“The focus on outbound transportation can be attributed to the fact that in-house private fleets handle finished products with a greater degree of care, pride and attention to customer service than what is available from many outside transportation alternatives,” NPTC said.

However, maintaining service levels while delivering a cost advantage remains challenging, NPTC noted, and private fleets continue to face driver-related challenges, such as an aging driver population, turnover and retention. Respondents also reported dealing with equipment- and maintenance-related challenges and rising costs.

Shorter Length of Haul

The average length of haul has dropped as distribution centers move closer to customers and now averages 178 miles, down from 242 last year. That shift is also affecting backhauls, and this year, respondents said their number of empty miles increased. “Today, the focus seems to be shifting from reducing empty miles to becoming more strategic and holistic. The closer private fleet operations get to the customer, the fewer opportunities exist for backhauls,” according to the report.

Fleet managers also reported that getting their units back home is more important, so they can be loaded with the primary product instead of chasing backhauls that often don’t pay as well and come with their own operational headaches.

Equipment and Technology

Having the right equipment and technology in place can help fleets increase efficiency, and private fleets continue to use a mix of owned, leased and rental assets, which they are equipping with technology to increase productivity and safety.

Among respondents, 40% reported owning most of their power equipment (more than 90%), 30% reported leasing all or most of their heavy-duty units (up from 26% last year), and 30% said they use a combination of ownership and leasing. Among those that lease, 76% of the leases are full-service leases, up from 62% last year.

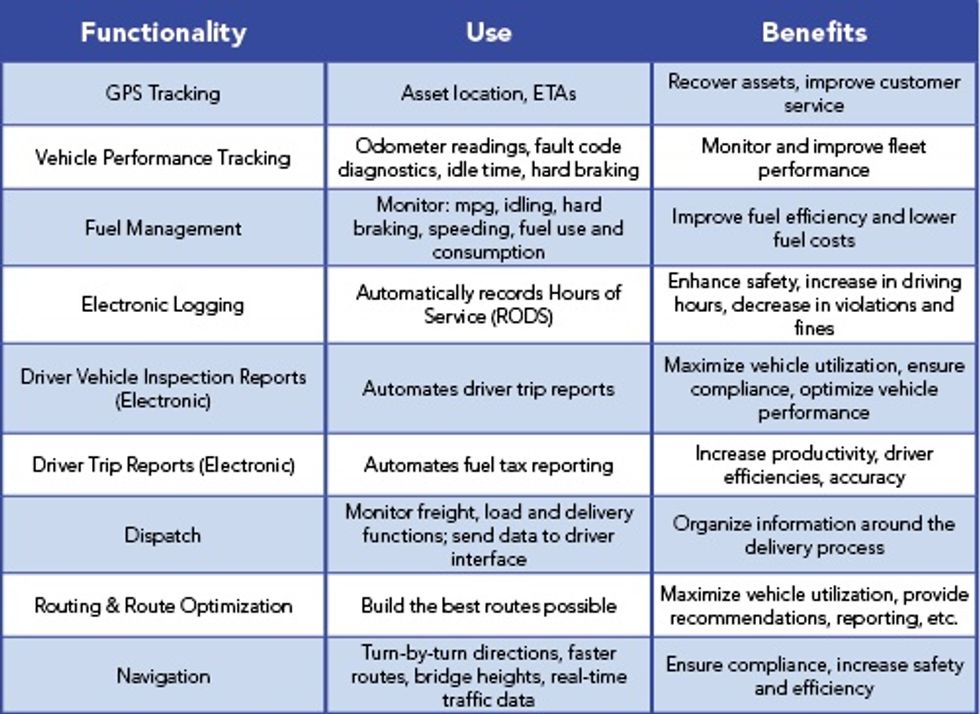

Technology use is high among private fleets, with every company taking part in the survey utilizing some form of onboard technology. Private fleets use technology in several ways, including addressing driver performance, fuel economy and idle time.

Nearly three-quarters of the survey reported adopting speed monitoring devices, in-cab cameras, collision warning, lane departure technology and automatic transmissions. “Across the board, fleets report increasing the penetration of these active safety technologies, providing them with more tools to aggressively manage the safety side of the business,” according to the report.

Private fleets also reported outstanding safety records, with a crash rate roughly three times lower than the industry average.

NPTC said private fleets are well positioned for the future, and 75% of respondents said they expect their fleet to grow in the next five years.