Electric powertrains, cleaner-burning diesel technology and alternative fuels are continuing to improve, and original equipment manufacturers, shippers and carriers are all moving toward net-zero goals, according to the fifth annual State of Sustainable Fleets report.

“If I had to really sum up the report for this year, there’s one word that comes to mind: growth,” said Erik Neandross, president of GNA, which produced the report. “Over the last 30 years, the market has had ups and downs, but over the 30-year period, the markets have grown 1,000%.”

While discussing the report in his keynote speech at the Advanced Clean Transportation Expo in Las Vegas, Neandross said that announcements about new, clean technologies are “seemingly nonstop.” He added that challenges remain, including costs, the amount of power available on the grid and infrastructure needs.

“We know it is not going to be easy. We know it is not going to be cheap, and we know it isn’t going to be a straight line quarter after quarter,” Neandross said.

Even still, OEMs are as committed as ever, and fleets are investing in new solutions. Neandross said the three big drivers are massive global investments in clean technology, growing commitments around sustainability and carbon reductions, and regulatory requirements. “We have a couple of really critical regulations that were adopted that are going to accelerate our move forward to lower carbon fuels and zero-emission vehicles in every sector: light, medium, heavy,” he explained.

Fuel and technology growth included:

Renewable Diesel: The national consumption of RD increased by 68% year over year, according to the report. Renewable diesel is considered a “drop-in” fuel, meaning it can be used as a direct replacement for diesel fuel in diesel engines. Most consumption occurred in the West Coast states. The report found that 75% of fleets currently using RD would buy it in greater quantities if they could access it without additional cost, and 63% have asked their providers about the option.

Natural Gas: Fleet demand for natural gas increased again in 2023, concentrated among existing users. Additionally, more than 150 new renewable natural gas production facilities came online in 2023. The growth helped sustain CNG prices and helped them be competitive with other fuel choices. The demand for RNG among fleets also grew for the third consecutive year.

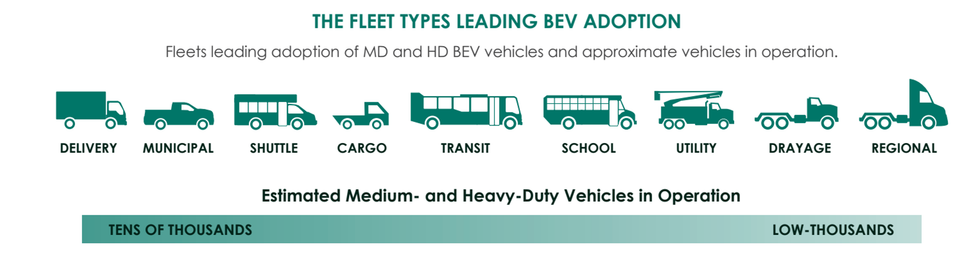

Electric Vehicles: More than 26,000 battery-electric trucks, vans, and buses were delivered to fleets in 2023, doubling since 2022. Cargo vans and pickup trucks made up 90% of those deliveries. Tractor deliveries grew sixfold, from more than 100 to nearly 700 units, while volumes doubled in virtually all other sectors. The State of Sustainable Fleets report found that at least 39% of the fleets surveyed in every sector reported using BEVs in 2023, the highest use rate across the five leading clean drivetrains for fleets.

Hydrogen: Growth of hydrogen in 2023 was spurred by federal investments in hydrogen production and infrastructure, notably the Department of Energy’s allocation of $7 billion to seven proposed fuel production and distribution hubs spanning 16 states. It will be several years before the H2 hubs meaningfully impact fuel price and supply, but the program is expected to reduce the risk for investors exploring hydrogen fuel and vehicle production. Major OEMs pursuing the hydrogen space include Kenworth, Peterbilt, Toyota, Hyundai and Nikola.

Diesel Technology: Fleets purchased about 7% more commercial trucks in 2023 than in 2022, signaling an upswing in demand as fleets rush to purchase new trucks before the EPA’s MY2027 heavy-duty engine standard kicks in. Estimates suggest this standard could raise diesel vehicle costs by approximately 12%.

Overall Energy Solutions

Charging infrastructure gaps and delays dominated discussions in 2023. Reliable access

to sufficient power is crucial to the success of any private or public charging facility, and

electrical service has become the make-or-break element of the first depot-sized projects, according to the report.

During the event, Penske Transportation Solutions and ForeFront Power announced their new joint venture — Penske Energy — to help commercial fleet operators plan, design and deploy optimized EV charging infrastructure capabilities that support and safeguard their operations.

Penske Energy will provide fleet operators with comprehensive EV charging and energy infrastructure advisory consulting, including strategic and operational planning, technology assessment, infrastructure designs and practical project implementation.

“We’ll work with our longstanding supplier partners in the energy and energy infrastructure sector and bring to bear the best possible solutions available for our commercial fleet customers,” said Drew Cullen, senior vice president of fuels and facilities at Penske Transportation Solutions.

Available Technology

Penske Truck Leasing has a wide range of low- and zero-emission solutions available today, including CNG, battery-electric and late-model diesel vehicles as well as renewable diesel. Learn more by contacting us today.

Source: The State of Sustainable Fleets 2024 Market Brief

Source: The State of Sustainable Fleets 2024 Market Brief